Strengthened financial structure for future growthĪs of June 30, 2022, company cash rests at 43.1 million euros, after settlement of the acquisition of Market Dojo, dividend payment and obtaining a new 12 million euro loan. The dynamic pace of signed contracts in Q2 was particularly noted in France, the United States and Australia. The Annual Recurring Value (ARR) of new contracts signed during Q2 2022 increased by 25% over Q2 2021 to 4.0 million euros (14.6 million euros, or +41% over the total duration of the contracts).

These products represent only 5% of company business.Įsker reported a record number of bookings in Q2. The performance of traditional licensed and legacy products declined sharply, in correlation with tightening market conditions. Once again, Esker has experienced its best quarter and half year in company history. Half-year sales revenue grew 19% based on current exchange rates (+13% based on constant rates) to 76.3 million euros. Service revenue is also not included in ARR as it is non-recurring.Įsker Q2 2022 sales revenue amounted to 39.8 million euros, an 19% increase over Q2 2021 based on current exchange rates (+12% based on constant rates). Revenue from platform transactions is not included as it is uncertain by nature and depends on the number of transactions effectively processed, which is not known at the time the contract is signed. ARR is the average annual subscription value that customers commit to pay over the life of a contract. Growth based on a constant exchange rate: 2022 exchange rates applied to 2021 figuresĮxpressed as Annual Recurring Revenue (ARR), a standard metric for SaaS or subscription business. Includes Esker DeliveryWare, Fax Servers and Host Access

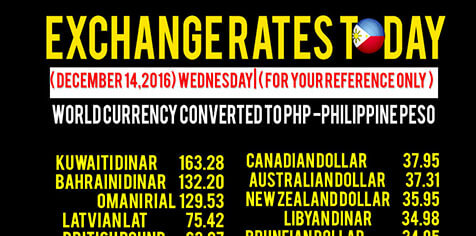

EXCHANGE RATES PROFESSIONAL

Includes implementation, training and Professional Services Includes subscriptions and transactional revenue

0 kommentar(er)

0 kommentar(er)